If you are a new client, please bring your tax returns from the prior year, including all forms and schedules. Please bring our signed engagement letter, questionnaire, Basic Info Organizer, and any of our other organizers that may apply. Using these organizers will help you to organize the documents you need to bring in, including the following forms and information: W-2, 1099-INT, 1099-DIV, 1099-B, 1099-SA, 1099-G, 1099-MISC, 1098 forms, childcare details (if applicable), student loan interest paid, and anything else that may seem relevant.

If you have any itemized deductions including real estate taxes, mortgage interest, medical expenses, contributions, etc., please use our appropriate organizer.

All forms listed above can be found here.

This is a difficult question to give an easy answer to because it depends on each situation. We bill by the project, and it depends on many factors: complexity of the tax return, number of transactions, organization of the data, risk levels, and tax code calculations. A self-employed person with a Schedule C will pay more than a person with two W-2 forms and some stock sales due to the above factors. Your all-inclusive investment with us, assuming no material changes from the prior year, will be similar to the prior fees with us, considering the nominal industry-standard annual inflation. We do reserve the right to make changes to the engagement fee as sometimes tax situations arise that we are unaware of at the time the engagement fee is established. Our prices are very competitive. For further information and/or a credit card payment slip, please see our information sheet.

We do not prepare your return during our meeting. We firmly believe that taking time to ensure that the return is as complete as possible is the most appropriate method for tax preparation and saves everyone time later on. We want to be able to research applicable laws if necessary and do a thorough review. That being said, we are always shooting for a two-week or less turn-around period. Becky will send you a reminder if we are waiting on documents or information from you.

Please review the Tax Process section on submitting documents here.

When we set up your client portal initially, you will receive an email with a link to select your login name. You may use your email address, or anything else that you wish. If you have already set up your login and cannot remember it, you may send Becky an email and she can get that for you.

When we set up your client portal initially, you will receive an email with a link to select your password. We do not have access to passwords as they are not stored in our records for security purposes. It is always a good idea to establish security questions to allow you to access your account if you forget your password and you will be prompted to do this upon initially setting up your account.

If you cannot remember your password, please click on the “forgot password?” link on the login page and it will allow you to reset the password. You will need to know your login for that, so if you cannot remember it, please email Becky.

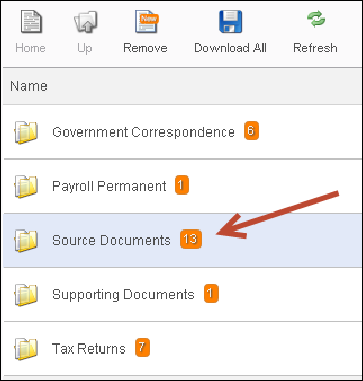

After you login to your client portal, click on the folder under the Documents section on the left side of the home page with your name on it. Then, click on the Tax Returns folder, and then the folder for the appropriate tax year and you will see pdf files with the word “PREVIEW” in the name. Click on each file to open. You may save these files or print them out, whichever you prefer.

Please review the Tax Process section on “what to do next” HERE.

Please review the Tax Process section on “where to get a copy of your return” HERE.

There are some circumstances where it is appropriate to file an extension. There are several pitfalls to avoid when filing an extension:

1) Extensions tend to give procrastinators false expectations. Instead of getting us their documents a week or two later, they often wait until the last days before it is due, and then wonder why we are not working overtime to get it complete for them.

2) Many people forget that an extension is only an extension of time to file NOT an extension of time to pay… the tax is still due April 15 even if you do not know how much you owe. This means that interest and penalties often surprise individuals when they owe a significant amount.

3) We end up saying “Please don’t shoot the messenger!” more times during the extension period than the normal tax prep period.

However, there are a few good reasons to take advantage of the additional time to file, so if you simply don’t have time to collect all of the appropriate info, by all means, take an extra week or two to make sure you have a complete tax return.

If we prepared your taxes from that year, then no, because we always return original documents. First place to look? The folder that we mailed to you once your tax return was complete. We always return original documents in that folder. If you were formerly a client of Wildboar Tax & Accounting, there should be a copy of that document in your portal. Go to the Documents section, click on the folder that lists your name, then select the folder called Source Documents. You can choose what tax year, and then you will see all the required government files. If you need something that you don’t see listed, please email us to ask if we have a copy of it. We don’t post everything that we scan, just the government documents.

If you are a new client, please bring your prior year tax return. There are many different ways to answer a question and they all depend on what tax bracket you fall into. If you are coming to talk about your business activities, a recent profit and loss statement and balance sheet make a big difference in narrowing the scope of our questions. If you do not have a profit & loss or balance sheet, a simple tally of total income received and total expenses (hopefully broken out by category) will be sufficient. Lastly, anything specific that you want to address with us, whether it be correspondence from the government, stock sale details, paycheck details for tax projections, etc.

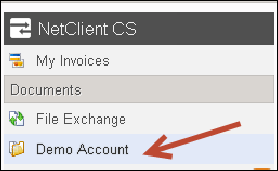

Yes, we’re glad you asked! Just go to the App Store or Google Play and search for NetClient CS Mobile. This free app will allow you to login and view your portal. You will need to know your login and password to access your files. If you cannot remember your login, try using your email address first.

For your federal tax return, you can check the status of your refund here:

https://www.irs.gov/Refunds

For your state tax return, you can check the status for some of our more common states below.

Oregon Refund Status

California Refund Status

Utah Refund Status

Arizona Refund Status

Idaho Refund Status

Hawaii Refund Status

For your federal tax return, we can file Form 9465 with your tax return, requesting this option. However, if you owe less than $50,000, and are trying to pay the total amount in less than 72 months, the IRS may not accept the form, but instead require you to register with them directly online to do the installment agreement.

If you would like to file Form 9465, please inform us of how much are able to pay with your tax return, and how much you are able to pay each subsequent month. Please note that the IRS will respond to your request via US Postal Service, but it will take a minimum of six weeks. For more information on IRS payment plans, see their webpage.

Oregon: We cannot file this for you, you will need to contact the Department of Revenue directly, through their payment option website.

California: We cannot file this for you, you will need to apply for an installment agreement directly online, through their website.

Utah: You may apply for a payment agreement directly with the State Tax Commission after they process your tax information, through their website.

Arizona: You may apply for a payment agreement directly with the Department of Revenue through their website.

Idaho: You may apply for a payment agreement directly with the State Tax Commission after they process your tax information through their website: ID business tax payments and ID personal tax payments.

Step-by-Step Instructions for Making Online Tax Payments (Fed & OR)